top of page

eCommerce Accounting

Practical accounting and tax guidance for UK eCommerce businesses, including Amazon FBA, Shopify, eBay, and online sellers. Covers bookkeeping, VAT, cash flow, software, and tax planning to help online businesses stay compliant and grow profitably.

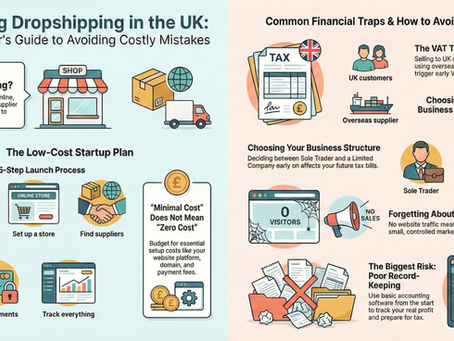

How Can a Beginner Start Dropshipping With Minimal Upfront Cost?

You don’t need a warehouse, thousands of pounds, or years of experience to start an online business but you do need a clear plan if you want dropshipping to work without costly mistakes. Dropshipping is often promoted as a “low-risk” way to start eCommerce, and while it can be low cost, beginners in the UK regularly run into problems around tax, VAT, and record keeping simply because they don’t set things up properly from day one. This guide explains how a beginner can start

Jan 64 min read

What Does an eCommerce Accountant Do? A Clear Guide for UK Online Sellers

If you’re running an eCommerce business, you might be great at sourcing products, handling orders, and growing your brand, but when it comes to your accounts and taxes, things can feel confusing, time-consuming, or even overwhelming. As eCommerce accountants , we help take the guesswork out of your financial admin, ensure you stay compliant with UK tax rules, and give you the insight you need to grow your business confidently. This guide explains exactly what an eCommerce acc

Dec 30, 20254 min read

bottom of page